Multiple districts — Calculator in hand, Grandville High School junior Olivia Evans added up the numbers on the page of her simulated monthly expenses, her face falling a little more with every addition. When she reached the final total, she buried her face in her arms.

“I’m in so much debt!” she cried in mock desperation. “I’m gonna die!”

Next to her sat Lake Michigan Credit Union branch manager Cody Timm, who shook his head sharply like a no-nonsense uncle.

“You’re not gonna die,” Timm reassured her matter-of-factly. “You’ll just have to drink water and eat a lot of ramen.”

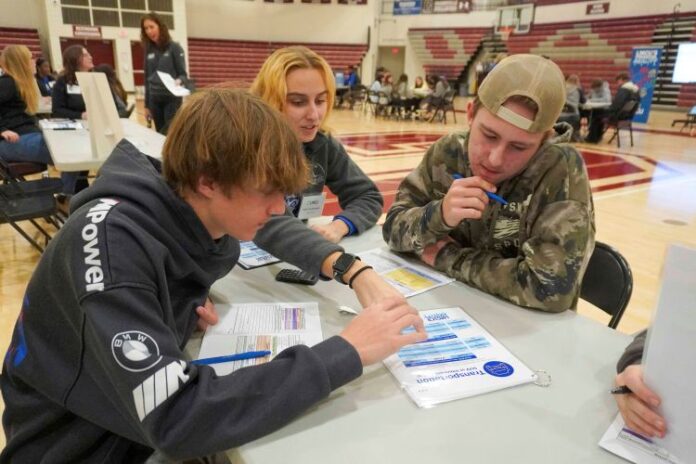

Students at both Grandville and Wyoming high schools experienced a taste of real-world budgeting recently as part of a Financial Reality Fair hosted by Lake Michigan Credit Union.

Led by Savannah Girmsheid, LMCU financial wellness manager, and other LMCU representatives, students visited several stations to figure out their monthly budgets.

Each student was randomly assigned an occupation and credit score and received information on their salary and take-home pay. They then fit monthly expenses including housing, transportation, personal care, TV/phone/internet, food and leisure into their budgets. They also visited a “surprise” station to receive an unexpected income source or expense, such as a monetary gift from a grandparent or a flat tire repair.

Under each category, they chose from a list of options, such as a new car, used car or taking public transportation. They also had the chance to sign up for a “side hustle” to bring in added income. All of these individual choices affected a student’s bank account total and credit card debt by the end of the month.

“Our goal is to expose students to the kind of choices they are going to have to make as they enter adulthood, as they get their first career and first salary and have to make some tough decisions about how they will allocate their income,” Girmsheid said.

‘I thought I had a pretty good idea of what things would cost, but it definitely was hard making some decisions.’

— Grandville High School junior Carter Wade

How Far Will Their Dollars Stretch?

At Wyoming High School, seniors Almin Pablo and Anessa Perez were both veterinarians with gross incomes of $88,000 a year. Nataari Pettaway was a lawyer making $115,000.

Despite their solid incomes, the three seniors had sticker shock a few times while fitting their take-home pay into a monthly budget.

“It’s harder than I thought,” said Nataari. “There are a lot of expenses, like groceries. That’s crazy. That’s a lot of money. That’s, wow. That’s just the beginning.”

According to Nataari’s budget, she would be spending $550 a month on food — not including going out to eat. “In reality, I am going to eat that much food,” she said.

The girls decided to be roommates to cut down on housing costs, paying $600 each, plus $15 in renters insurance and $60 in utilities per month. A practical bunch, they decided on used furniture and to donate time to charities rather than make monetary contributions. But they splurged on a pet monkey, costing a total of $583 between the three of them and $21 for monthly care.

Almin also added a gym membership for $15 a month, noting that she might spend more on healthy eating, too.

“This is a game. When it comes to the real world, it’s going to be way, way worse with inflation,” Nataari said.

“I feel like, in the real world, I’m going to spend more,” added Almin.

In the Red or Black?

In Grandville, juniors Carter Wade and Yuli López each received the occupation of journalist, with a modest monthly take-home pay of $2,246 after taxes. The choices they made and situations they faced throughout the month, however, took their bank accounts in vastly different directions: Carter ended the month $66 in debt, while Yuli was able to save $596.

Looking back at the decisions he made, Carter guessed his first mistake was going for a solo one-bedroom apartment. But he was also surprised by how quickly ordinary expenses, like clothing and Netflix subscriptions, added up.

“I didn’t really put my salary into account at first,” he said. “I thought I had a pretty good idea of what things would cost, but it definitely was hard making some decisions. At the stations l started looking back at (previous decisions) and kind of second-guessing them.”

Despite Yuli managing to stay out of debt, she also didn’t have an easy month; at her “surprise” station, she was hit with an unexpected $325 medical bill.

“That’s a lot of money, and it wasn’t even like a major accident,” she lamented. “Like, if I had to go to the emergency room I would probably have to pay a lot more.”

‘There are a lot of expenses, like groceries. That’s crazy. That’s a lot of money. That’s, wow.’

— Wyoming High School senior Nataari Pettaway

In her real-life finances, Yuli said she once tried making a budget, but didn’t stick with it, “because I didn’t like doing it.” After going through the LMCU simulation, however, she’s rethinking that decision. She hopes to purchase a car soon, and said a budget will likely help her save money.

“I liked (the simulation) because it helped me experience something like my future,” she said. “I’m thinking about doing administration and real estate, so it helped me think, like, how much I want to pay for college, where I’m going to live, if I’m going to live with someone or not. … I had to prefer the cheap things, and be responsible to pay my credit card when I actually wanted some expensive things.”

Understanding Everyday Costs

Both Carter and Yuli are in Grandville teacher Ryan Zuiderveen’s economics class, where they’re currently studying inflation. The teacher said students have been examining prices of everyday items such as dairy products and used cars, making this financial exercise all the more relevant.

“Understanding your money coming in and your money going out is just really important with the inflation we’ve had ever since COVID,” Zuiderveen said. “And if you look at what’s coming next for (high school students), they might be taking out college loans, and there’s so much easy credit right now. Without knowing what payback looks like on a $30,000 loan, you can get yourself in a hole real quick.”

Wyoming High School personal finance teacher Nathanael Juliot agreed that the fair complemented what students learn in class about life after high school.

“We’ve started to talk about budgeting in class this last couple weeks, and this is really a chance for them to test it out … and consider all the expenses they will have to take care of as someone who will be doing that very soon,” Juliot said.

LMCU hosted nine financial simulation events last year, and has several more planned this school year in West Michigan districts.

Zuiderveen said he appreciated the way the credit union encouraged his students to think realistically about the future and invest in themselves.

“There’s nothing worse than turning 18 or 22, finishing up your education, and then just kind of getting hit in the face with all these responsibilities,” the teacher said. “I think this helps them think about setting appropriate expectations.”

Reporter Beth Heinen Bell contributed to this story.

Read more from our districts:

• Tasting new book genres broadens reading palates

• Local districts mirror statewide growth, student success in AP courses